Over long periods of time, compound growth can exponentially grow your retirement nest egg. In the second year, assuming the same rate of return, your balance is $1,210, a $110 gain. Here’s how it works: If you invest $1,000 and earn a 10% annual return, your balance grows by $100 to $1,100 after the first year. Reinvesting your returns allows you to earn even greater future returns with compounding. By allowing you to defer (or avoid entirely) paying taxes on your investments, these accounts, like traditional and Roth 401(k)s, help you grow your balance faster than if you invested with a taxable investment account. Retirement plans like your workplace 401(k) are tax-advantaged accounts, meaning your contributions earn special tax treatment. If you’d like to save even more for retirement, consider opening an individual retirement account ( IRA), which gives you another $6,000 in tax-advantaged contributions, or $7,000 if you’re 50 or older. You can contribute up to $20,500 to your 401(k) account in 2023, or $27,000 if you’re 50 or older. If you work for a non-profit or government organization, you may have a 403(b) or 457(b) instead, which work similarly to 401(k)s and provide nearly identical benefits. 401(k) plans let you invest in mutual funds and index funds, growing your savings over time. Companies offer this popular option to help employees save for retirement, with contributions deducted from each paycheck. We’ve assumed that your investments will return an average 9% before you retire, reflecting historical long-term averages of stock portfolios. The securities you choose to buy with your retirement savings determine the rate of return on your investments, not to mention the overall performance of the stock market. Hopefully you have more than this saved for retirement already, but for the purposes of this calculator, we set our default to represent someone starting from scratch. According to research from Transamerica, this is the median age at which Americans retire. Your salary may increase more or less than this average, but it’s generally safe to assume your income will keep up with inflation, which historically has grown at a rate of about 2% per year. The Social Security Administration estimates that average incomes have risen by this amount each year over the past decade. This is a critical piece of information for your 401(k) plan because it’s a benchmark for determining how much you can afford to contribute. While your annual salary may be higher or lower, $31,000 is the median income in the U.S. They may get to that percentage using a dollar-for-dollar contribution or a custom formula that might, for example, match 50% of your contribution amount up to 6% of your total annual salary. According to Fidelity, the average employer match is 4.6%. That means your employer also contributes money to your 401(k) account as a job benefit. Many employers choose to match you 401(k) contributions up to certain limits.

Fidelity Investments recommends that you should be saving at least 15% of your pre-tax salary for retirement. Retirement experts suggest that you contribute at least 10% of your salary to your 401(k) account, but even this may not be enough for a secure retirement. If you don’t have data ready to go, we offer default numbers based on the finances of the average American. Our calculators can accommodate just about any design requirement that CSS permits and are the ideal solution if you are looking for a seamless design experience for your website.To get the most out of this 401(k) calculator, we recommend that you input data that reflects your retirement goals and current financial situation.

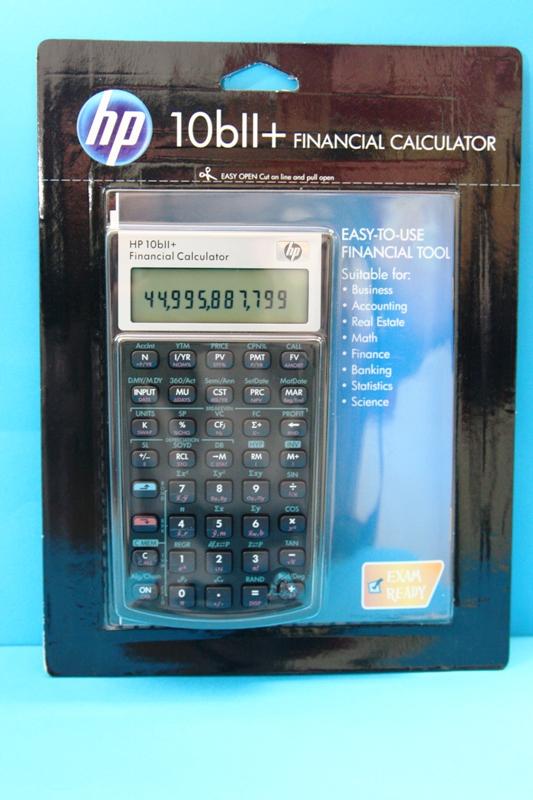

#Good financial calculators code

We can round corners, shade backgrounds, and of course, we can match color schemes down to the hex code level. Each element of our Financial Calculators has it is own CSS class and ID, allowing us to customize, fonts, font sizes, styles, and colors. One of the most exceptional features of our calculators is their ability to meet the most exacting style requirements for integration into financial websites. If you are looking for financial calculators that can be customized to meet your exact brand and style requirements, look no further.

They will work across desktop, tablet and mobile devices. Responsive Design for Desktop, Tablet and Mobile Devicesįintactix's Financial Calculators are built upon Bootstrap, the most popular open-source HTML, CSS, and JS framework for developing responsive, mobile first projects on the web.

0 kommentar(er)

0 kommentar(er)